Every August, Singaporeans celebrate with fireworks, festivities, and special deals. But this year, many will also cheer for the GST voucher (GSTV), with some receiving up to S$850 in cash.

So, what is GSTV? It’s a government scheme to support lower- and middle-income households and seniors, offsetting the burden of the 9% Goods and Services Tax (GST). Unlike other direct government payments, GSTV specifically aims to help with GST costs.

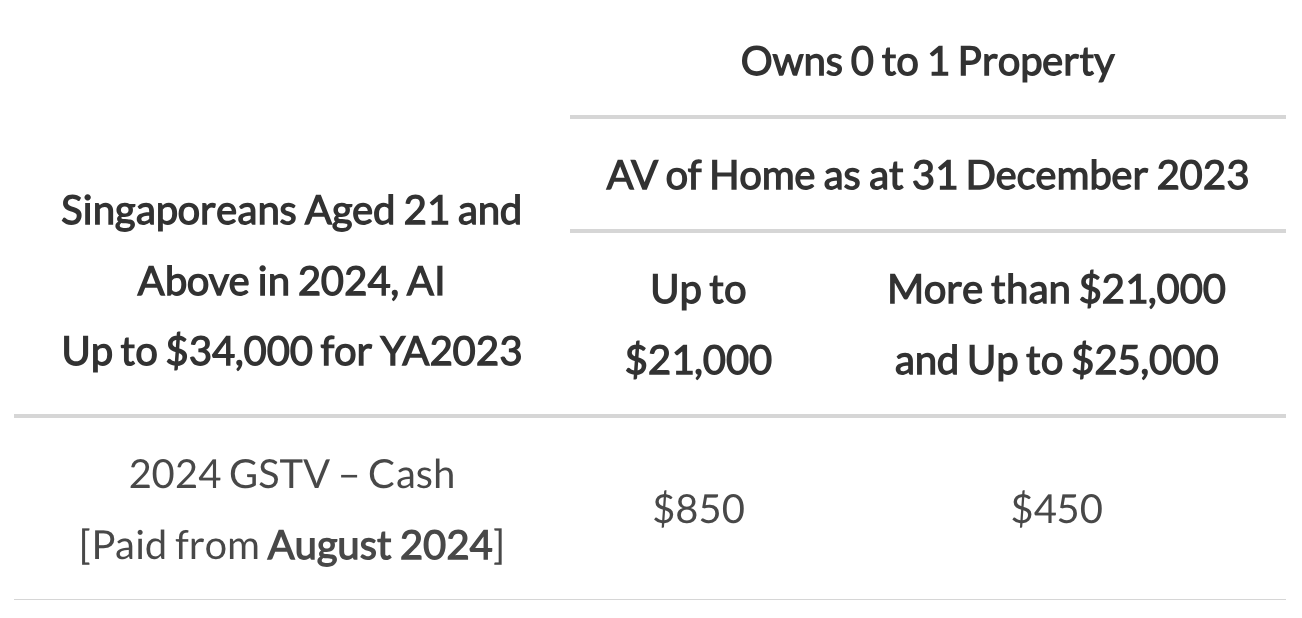

Screenshot via govbenefits.gov.sg.

Introduced in 2012, GSTV includes cash payouts, MediSave top-ups, utility offsets, and Service & Conservancy Charges (S&CC) rebates. This year, 1.5 million Singaporeans, about a quarter of the population, will receive cash payouts.

To qualify, you must be a Singaporean, 21 or older in 2024, residing in Singapore, and not owning more than one property. The two main disqualifiers are earning over S$34,000 a year or having a home's Annual Value (AV) of S$21,000 or more.

To be eligible for the GST Voucher (GSTV) in Singapore, you must meet the following criteria:

- Citizenship: You must be a Singaporean citizen.

- Residency: You must be residing in Singapore.

- Age: You must be 21 years old or above in 2024.

- Property Ownership: You should not own more than one property.

- Income: Your annual assessable income must not exceed S$34,000.

- Annual Value of Home (AV): The AV of your home must be less than S$21,000.

Meeting these criteria qualifies you for the GSTV cash payout, which aims to help lower- and middle-income households manage the costs associated with the Goods and Services Tax (GST).